Renewable Energy:Feed-in-Tariff Scheme

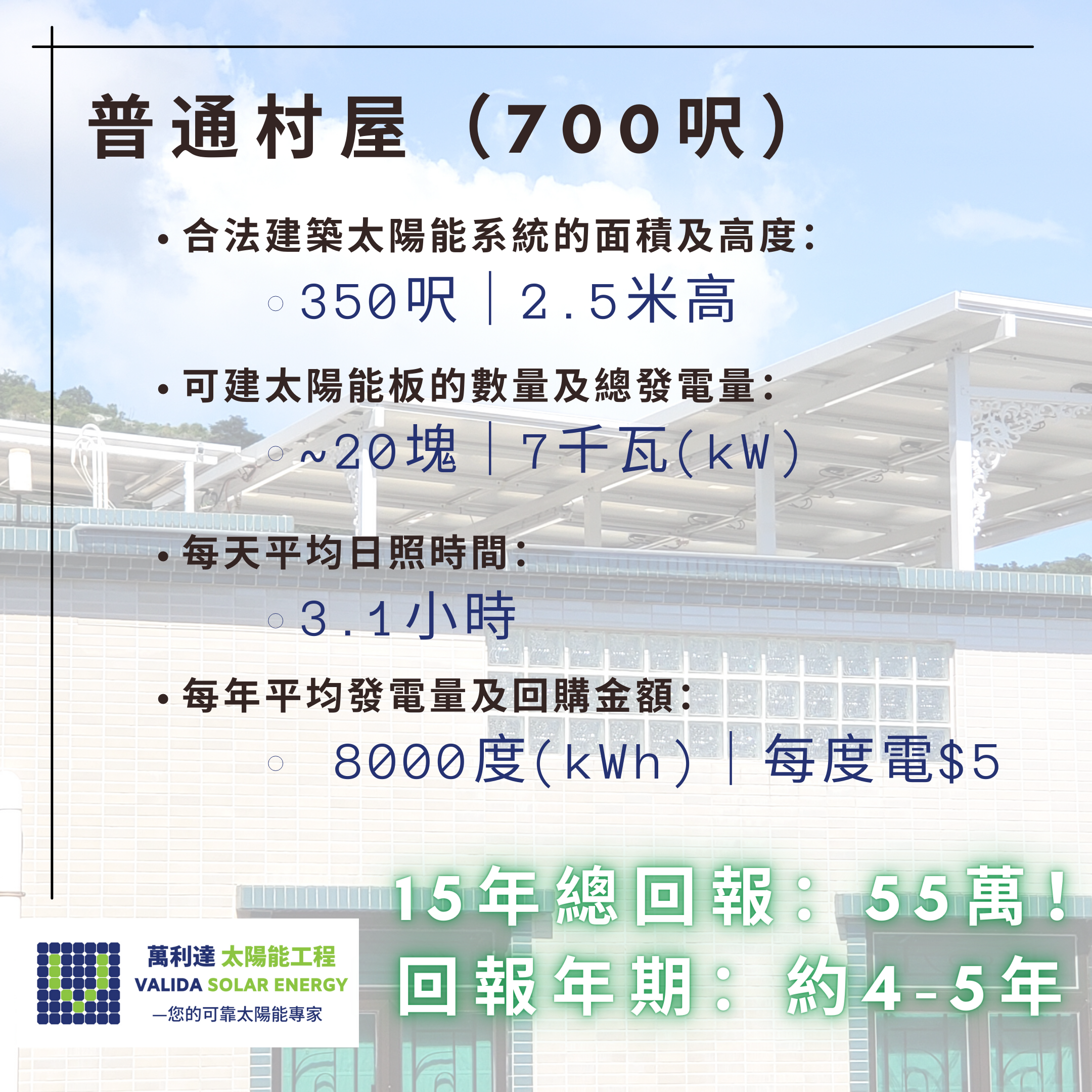

From 1st October 2018 onwards, once the system is connected to the electric grid, you can earn FiT payment (ranges from $3-5/ kWh), until 31st December 2033. So if you have a place where you can build a solar energy system, for instance, village house/ villa’s rooftop, residential building roof, industrial building roof, carpark space, warehouses, you are eligible to earn regular income for 15 years.

1. Who is eligible to join the Feed-in-Tariff Scheme?

You are a registered CLP account holder (not applicable to government bodies)

Your renewable energy system is powered by solar and/or wind and is located on your premises with a total generation capacity of up to 1MW

Your renewable energy system can be connected to the CLP network without any increase in capacity or network reinforcement work by CLP

2. Places that can install solar energy system

Village House : Canopy, Rooftops, Gardens, Carpark space.

Villas:Canopy, Rooftops, Gardens, Carpark space.

Residential Building: Rooftop, Cabinets.

Industrial Building: Rooftop, Cabinets.

School: Rooftop

Warehouse: Tiles Rooftop

3. How to calculate the FiT rebate?

Depends on the constructible area, different size of solar energy system can be built:

If the total system capacity is less than 10kW, the FiT rate is $5 per kWh, generally applicable to village houses and villas.

If the total system capacity is between 10kW to 200kW, the FiT rate is $4 per kWh, generally applicable to industrial building and schools’ rooftops.

If the total system capacity is between 200kW to 1000kW, the FiT rate is $3 per kWh, generally applicable to warehouses and agricultural land.